South Korea Eyes Ownership Caps for Crypto Exchanges

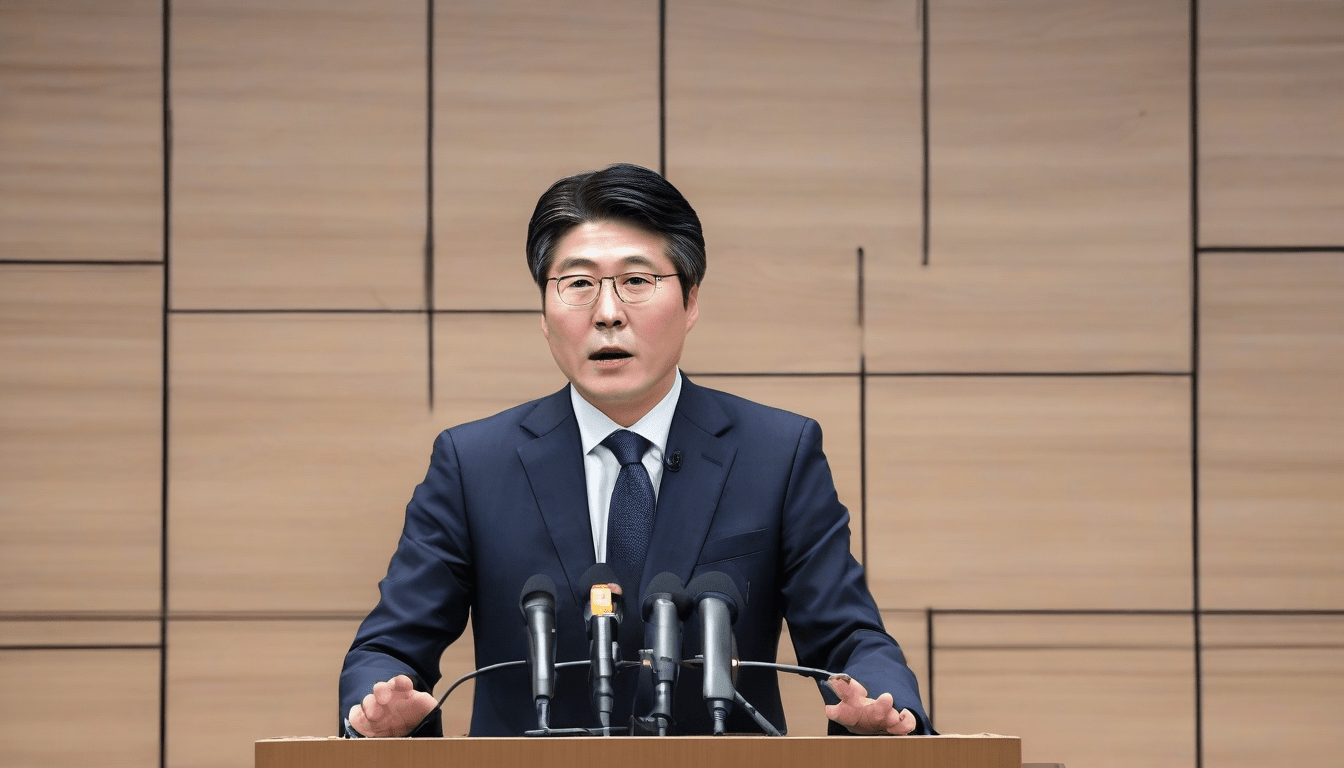

Generally, I think the Financial Services Commission is looking at a plan to limit any single owner to just 15, 20% of a crypto exchange. Obviously, this idea is part of the upcoming Digital Asset Basic Act, which tries to bring order to the fast growing digital asset world. Normally, Lee Eog-weon, the FSC chair, told reporters that exchanges shouldn’t act like private clubs any more, they need to be run like public financial infrastructure. Basically, he said the current rules only chase money laundering and investor safety, but they miss the bigger picture of governance, you know.

Regulator Pushes for 15–20% Ownership Cap

Usually, the regulator worries that if one person holds too much power, it could skew the market and hurt transparency. Apparently, under today’s notification-based regime, exchanges renew every three years, but the new law would switch to an authorization system giving permanent licenses. Often, Lee compared this to how securities exchanges already have ownership caps, hoping crypto platforms follow suit, which is pretty interesting. Essentially, it’s about stopping monopoly vibes and keeping the playing field fair, you see.

Why Ownership Limits?

Clearly, big players like Upbit, Bithumb, and Coinone are not happy with the proposal, and their joint council warned that caps could choke innovation and slow South Korea’s crypto growth. Obviously, Dunamu’s chair, Song Chi-hyung, currently holds about 28% of Upbit, while Coinone’s founder Cha Myung-hoon sits on 53% of his company, numbers that would force big sell-offs if the rule passes, which is a lot. Normally, some lawmakers from the Democratic Party say the limits are unusual worldwide and might isolate Korea, which is a valid point.

Industry Pushes Back

Generally, the ownership cap isn’t the only thing on the table, and last month regulators announced they’ll tighten the travel-rule, dropping the transaction threshold from 1 million won to even smaller amounts. Apparently, that move aims to catch money-laundering early and protect the financial system, which is a good thing. Usually, the regulator is trying to balance tighter oversight with keeping the space vibrant, a tricky dance in one of Asia’s hottest crypto hubs, you know.

Broader Regulatory Crackdown

Obviously, the Digital Asset Basic Act should be wrapped up in the next few months, although political fights and industry lobbying could slow it down, which is pretty normal. Normally, if it passes, crypto exchanges will be forced to operate more like traditional banks, which could be a big shift for the market, and that’s a fact. Essentially, the regulator is trying to make the space more secure, and that’s what you want, right.

What’s Next?

Usually, I think the future of crypto exchanges in South Korea is uncertain, and the new law could change everything, which is kind of exciting. Apparently, the regulator is trying to find a balance between oversight and innovation, and that’s not easy, you see. Generally, the Digital Asset Basic Act is a big deal, and it will be interesting to see how it all plays out, and what you think about it, matters.