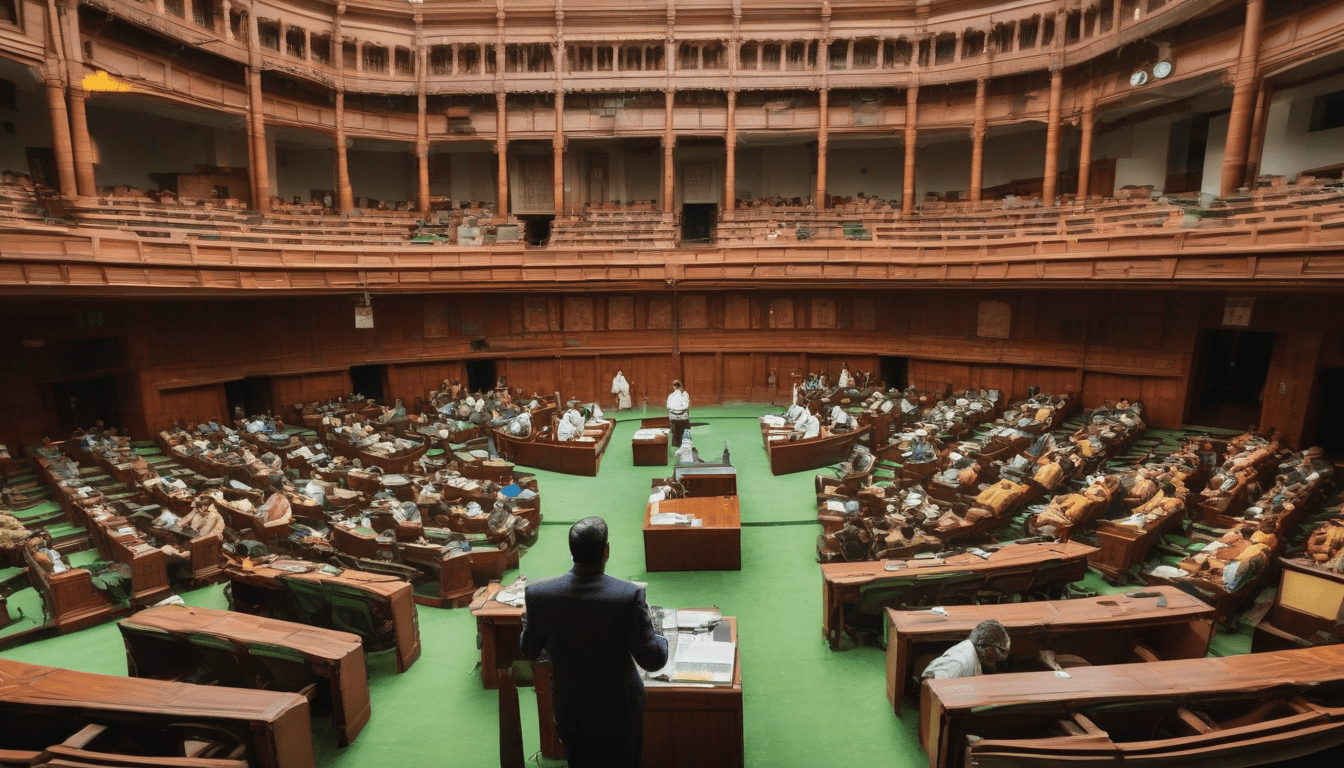

India’s Tokenization Bill: Unlocking Real Estate for the Middle Class

Generally, You Should Be Aware That India’s Parliament is currently debating a new Tokenization Bill. Obviously, This proposal could revolutionize access to real-estate and other high-value assets for the middle class. Normally, The idea behind this bill is to allow fractional ownership through digital tokens, making investments more accessible and liquid. Apparently, This is a major step forward for financial inclusion in India.

Overview

Usually, New laws and regulations can be confusing, but You need to understand that tokenization could be a game-changer for financial inclusion. Clearly, India’s Unified Payments Interface (UPI) has already simplified everyday payments for millions, and tokenization could have a similar impact. Naturally, The middle class in India primarily relies on savings accounts, fixed deposits, and mutual funds, with limited exposure to assets that generate higher long-term returns. Probably, This is why the Tokenization Bill is so important.

Why Tokenization Matters

Normally, People like Raghav Chadha, a Member of Parliament, are championing the Tokenization Bill because it could provide more opportunities for the middle class. Obviously, Tokenization could enable ordinary investors to purchase small stakes in office buildings, highways, and other capital-intensive projects, providing faster liquidity without the need for brokers or complex paperwork. Generally, This would be a major benefit for investors in India. Typically, The lack of access to high-value assets has been a major hurdle for the middle class in India.

Fractional Ownership Benefits

Apparently, Fractional ownership would allow You to invest in assets that were previously out of reach. Clearly, This would provide more opportunities for the middle class to generate wealth. Usually, The process of buying and selling assets would be much simpler and more efficient. Naturally, This would lead to more investment and economic growth in India. Probably, The benefits of fractional ownership would be felt across the economy.

Current Initiatives

Regulatory LandscapeUsually, Regulators like the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) are proceeding with caution when it comes to tokenization. Obviously, They want to make sure that investors are protected and that the risks are mitigated. Normally, This is why they are emphasizing the need for bespoke legislation and a regulatory sandbox to test new models under supervision. Generally, The regulatory landscape is complex and evolving, but it is an important part of the tokenization process.

State-Level Efforts

Apparently, Some states in India, like Maharashtra, are exploring ways to unlock idle capital by digitizing asset transfers, particularly in Mumbai’s real-estate market. Clearly, This could provide a major boost to the economy. Usually, The state government is looking for ways to simplify the process of buying and selling assets, and tokenization could be a key part of this effort. Naturally, The benefits of tokenization would be felt at the state level, as well as the national level.

Global Context

Normally, India is not the only country that is exploring tokenization. Obviously, Other countries, like the UAE, Singapore, Germany, Hong Kong, and the United States, have already adopted clearer legal standards for tokenization. Generally, This means that India is playing catch-up, but it also means that there are opportunities for India to learn from other countries and improve its own regulatory framework. Usually, The global context is important, because it shows that tokenization is a global phenomenon, and India needs to be part of it.

Criticisms & Challenges

Usually, There are some criticisms and challenges associated with tokenization. Obviously, Some people are concerned that participation will be limited by income levels and financial literacy. Normally, This is a valid concern, because tokenization is a complex process that requires a certain level of understanding. Generally, Policymakers also face hurdles such as complex land titles, fragmented state laws, and data-privacy concerns. Apparently, These are all important issues that need to be addressed.

Future Outlook

Normally, The future outlook for tokenization in India is promising. Obviously, If the Tokenization Bill is successful, it could unlock significant economic opportunities for the middle class. Generally, A robust and inclusive regulatory framework will be essential to realize the full potential of tokenization. Usually, This means that policymakers need to work together to create a framework that is fair, transparent, and secure. Apparently, The benefits of tokenization could be felt for generations to come.