Vitalik Buterin’s $70K Polymarket Profits Explained

Betting Against the Odds

Generally, I Think Vitalik made seventy thousand dollars by betting opposite to the hype on Polymarket, which is pretty cool. Obviously, He called his method “anti‑insanity mode” and it’s basically going against the crowd, you know. Apparently, The strategy was simple: spot markets that felt too crazy and wager the opposite outcome, like when he bet Trump wouldn’t win the Nobel Peace Prize. Normally, The market was wrong, and he was right, which is kinda interesting. Also, He said the dollar won’t hit zero even when panic spreads, and he was right, so that’s a good thing.

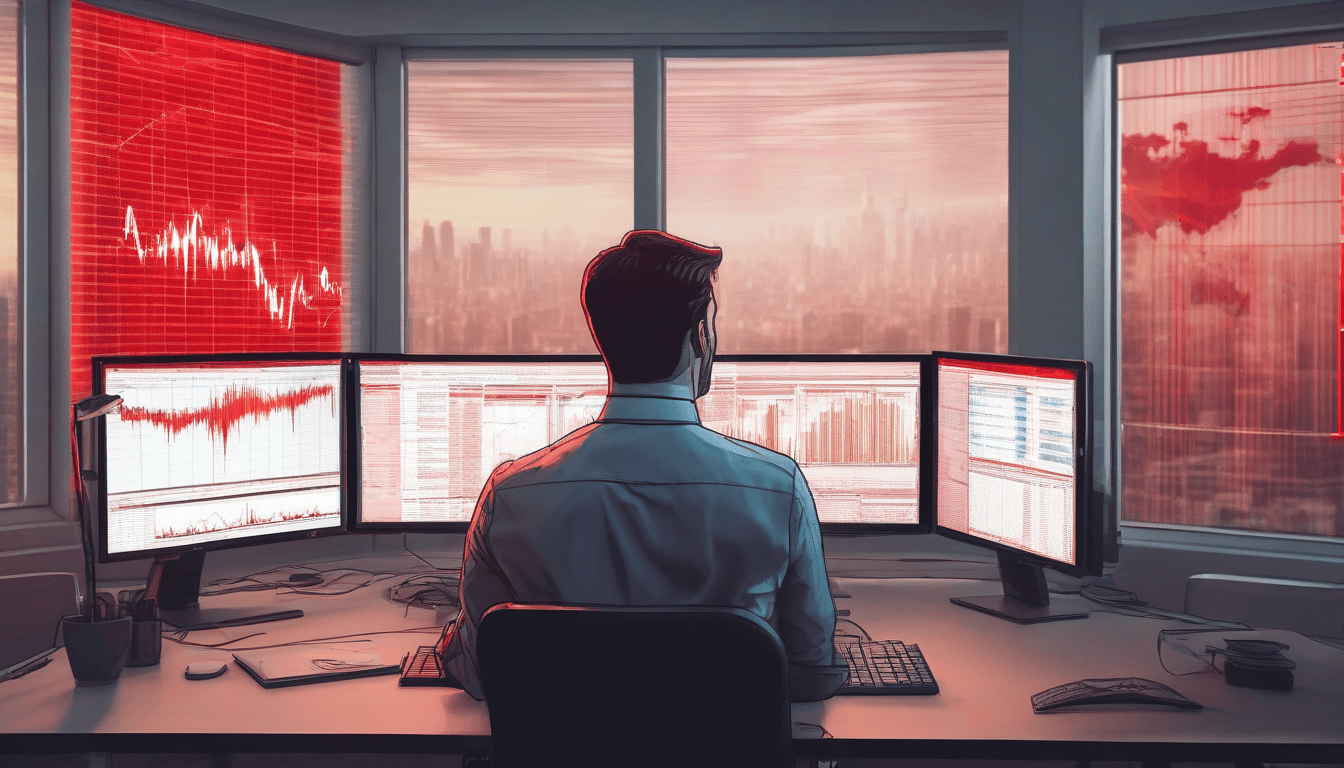

Usually, Polymarket grew fast, app installs jumped 1,200% in 2025 and weekly volume hit nearly six billion dollars from half a billion, which is a big deal. Probably, This shows more people are playing with real‑world events for profit, and that’s a trend we should watch. Maybe, The growth of Polymarket is a sign that people are looking for new ways to make money, and that’s a good thing.

Three Critical Challenges for Crypto’s Future

Preventing Speculation Over Substance

Honestly, He warned crypto could turn into pure speculation if projects don’t solve real problems, which is a real concern. Naturally, “My biggest fear is that the whole industry becomes a hype machine,” he said, and I think that’s a real danger for the space, you know. Generally, I think that’s a good point, and we should be careful not to let speculation take over.

Improving Ethereum’s Technology

Apparently, Vitalik bragged that gas capacity doubled to sixty million, yet he wants three hundred million this year, which is a big goal. Obviously, He also wants Layer‑2s to be faster and more decentralized, which is a good thing. Maybe, A MigaLabs report shows data‑heavy blocks cause missed slots above 1.7% when blob counts are over sixteen, which is a problem we need to solve.

Countering Centralized AI Dominance

Normally, He fears a future where AI is run by a few big firms if crypto fails its promise, which is a scary thought. Generally, “That would be a dangerous future,” he warned, and I feel that crypto must stay a tool for freedom, you know. Probably, We need to make sure that crypto stays decentralized and doesn’t fall into the hands of a few big companies.

The Paradox of Prediction Markets

Generally, Prediction markets are booming, yet most bets are short‑term like hourly Bitcoin moves, which is kinda weird. Obviously, Those bets don’t really change the world, Vitalik said, and I think he’s right. Maybe, We need long‑term models like Futarchy, where markets guide policy, and that’s a good idea.

Apparently, MetaDAO is already testing this, using markets for governance instead of pure gambling, which is a good thing. Normally, I think that could make markets matter beyond speculation, and that’s a positive development.

Oracle Vulnerabilities: A Ticking Time Bomb

Honestly, Oracles feed data to contracts, but they’re fragile, which is a big problem. Generally, Vitalik gave a case where a Ukrainian conflict market on Polymarket flipped from 5% chance to certainty after a map error, which is a crazy example. Maybe, The market corrected later, but the damage was done, and that’s a concern we need to address.

Obviously, He listed two big problems: centralized oracles like Bloomberg give a single point of failure, and token‑voting oracles like UMA let whales sway outcomes, which is a risk we need to mitigate. Normally, Even honest voters can lose money if they go against the crowd, and that’s not fair.

The Prediction Market Boom

Generally, Polymarket got CFTC approval and re‑entered the US market with ultra‑low taker fees of ten basis points, which is a big deal. Apparently, It also landed a two‑billion‑dollar investment from ICE, valuing the company near nine billion, which is a huge investment. Maybe, That shows institutions are betting on the sector, and that’s a positive sign.

What’s Next for Ethereum and Crypto?

Normally, Beyond tech upgrades, Vitalik wants decentralized social networks and smarter DAOs, which is a good goal. Generally, “It can’t just be about issuing a token and having a vote,” he said, and I agree; governance must match the org’s real goals, you know. Maybe, We need to make sure that crypto is used for real-world problems and not just for speculation.

Apparently, The Ethereum Foundation is spending two million dollars on post‑quantum research and created a dedicated team, which is a big investment. Generally, The industry sits at a crossroads: keep innovating or fall into hype and central control, and that’s a critical decision. Maybe, Vitalik’s bets, both money‑wise and philosophical, show he’s leaning toward innovation, and that’s a good thing.