Walmart’s AI Strategy: A $905 Billion Bet on the Future

Generally, You should be aware of Walmart’s AI approach, which is Actually focused on specialized tools trained on their proprietary retail data. Apparently, This strategy is Pretty surgical, with AI agents deployed for specific tasks that can be combined to solve complex workflows, According to CTO Hari Vasudev.

Normally, You would expect Some tangible applications of this strategy, which includes Trend-to-Product System, GenAI Customer Support Assistant, Developer Productivity Tools, and Wallaby, a retail-specific language model trained on decades of Walmart transaction data.

Certainly, The backbone of this strategy is Element, Walmart’s proprietary MLOps platform, Designed to avoid vendor lock-in and optimize GPU usage across multiple cloud providers.

Obviously, Element gives Walmart the speed and flexibility that competitors using third-party platforms can’t match, Which is a big deal for the company.

The Agentic AI Pivot

Usually, You would think that Walmart’s AI strategy is not about generic solutions, Instead, the company is focusing on “purpose-built agentic AI”.

Apparently, This approach is yielding Some tangible results, including Trend-to-Product System, which Reduces fashion production timelines by 18 weeks, and GenAI Customer Support Assistant, which Autonomously routes and resolves customer issues.

Normally, You would expect Developer Productivity Tools to Handle test generation and error resolution within CI/CD pipelines, and Wallaby to power everything from item comparison to personalized shopping journeys.

Generally, The company is making structural investments in proprietary infrastructure and deploying AI at scale with measurable operational benefits.

Measurable Impact

Clearly, Walmart has been transparent about the ROI of its AI investments, with Data Operations improved by GenAI, which enhanced over 850 million product catalog data points.

Apparently, Supply Chain Efficiency has been optimized with AI-powered route optimization, which eliminated 30 million unnecessary delivery miles and avoided 94 million pounds of CO₂ emissions.

Normally, You would expect Store Operations to benefit from Digital Twin technology, which predicts refrigeration failures up to two weeks in advance, auto-generating work orders.

Usually, Customer Experience has been improved with Dynamic Delivery algorithms, which analyze traffic patterns, weather conditions, and order complexity to predict delivery times down to the minute.

Workforce Implications

Generally, CEO Doug McMillon has been candid about the impact of AI on jobs, stating that “AI is going to change literally every job”.

Apparently, This change is Positioned as a transformation rather than an elimination of jobs, with the company expecting total headcount to remain flat even as revenue grows.

Normally, You would think that jobs will shift rather than disappear, and Walmart is investing heavily in reskilling programs to help employees transition to new roles.

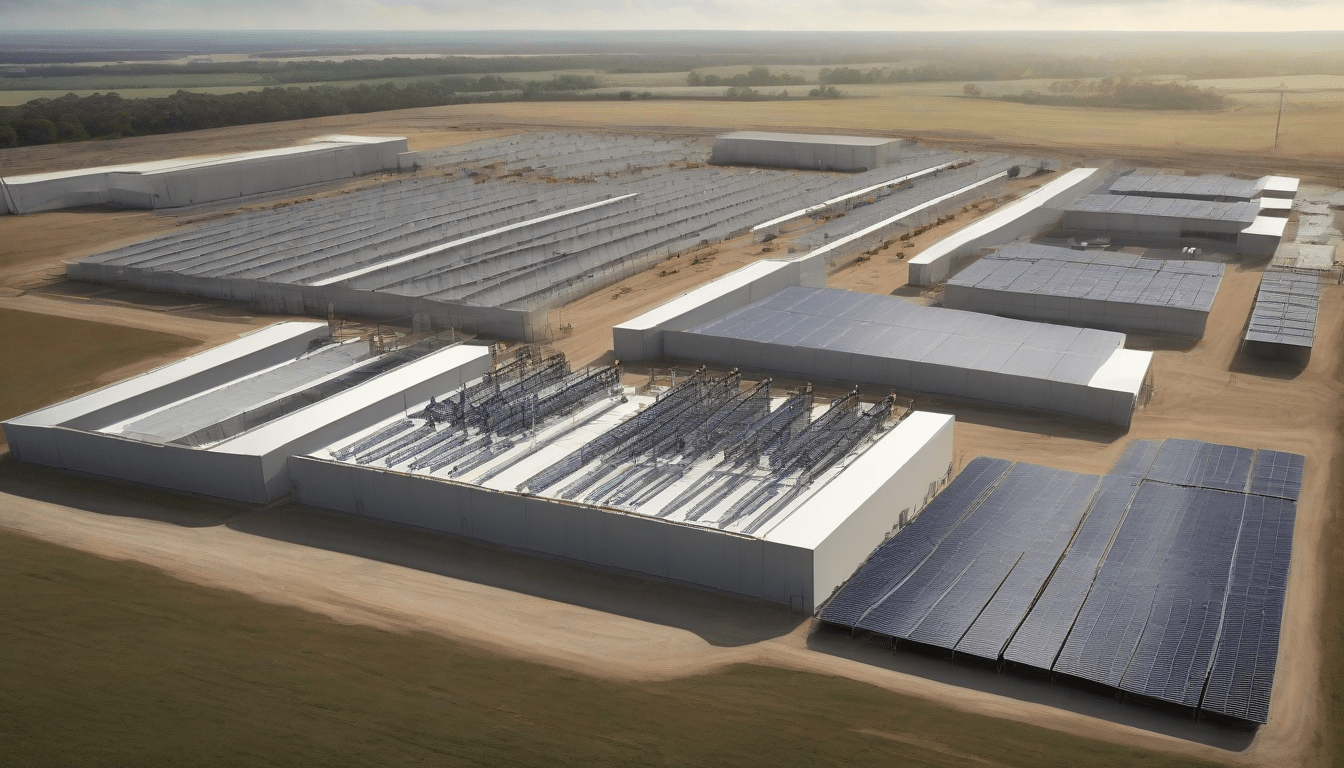

Usually, Automation equipment operator Chance at Walmart’s Palestine, Texas, distribution center described the shift from physical to mental work.

Repositioning for Tech Valuations

Clearly, Walmart’s move to Nasdaq is part of its strategy to reposition itself as a tech-powered enterprise, with CFO John David Rainey stating that the move reflects the company’s commitment to integrating automation and AI.

Apparently, This strategy aims to give Walmart the valuation multiples that tech companies command, but analysts are divided on whether this premium is justified.

Normally, You would expect some analysts to see Walmart as more of a technology firm, while others note that the company still derives revenue from razor-thin retail margins.

Usually, The company’s valuation will depend on its ability to execute its AI strategy and deliver sustainable competitive advantage.

Verdict: Genuine Transformation with Execution Risk

Generally, Walmart’s AI strategy is neither pure hype nor guaranteed success, with the company making structural investments in proprietary infrastructure and deploying AI at scale with measurable operational benefits.

Apparently, Significant execution risks remain, such as managing fragmented agent ecosystems, preventing algorithmic bias at scale, and competing against external shopping agents.

Normally, You would think that the company’s success will depend on its ability to manage these risks and deliver sustainable competitive advantage.

Usually, The question isn’t whether Walmart is using AI—it clearly is—but whether this approach will deliver sustainable competitive advantage or simply automate the company into the same low-margin trap with shinier tools.

Conclusion

Certainly, Walmart’s AI strategy is a bold bet on the future, with the company making genuine transformations with measurable impacts.

Apparently, There are also significant risks and challenges, but the company’s commitment to integrating automation and AI is clear.

Normally, You would expect the company’s success to depend on its ability to execute its AI strategy and deliver sustainable competitive advantage.

Usually, The future of Walmart’s AI strategy will be shaped by its ability to manage execution risks and deliver sustainable competitive advantage.